The Biden-Harris administration is investing US$32 million in production facilities that will extract rare earth elements (REE) and other critical minerals from coal for use in sustainable technology.

The United States Department of Energy (U.S. DOE) announced the funding Thursday as part of Joe Biden’s Investing in America agenda aimed at promoting private sector investments throughout the country and lessening U.S. reliance on foreign markets. Biden said Friday that under the agenda all American electricity would be generated through clean energy sources by 2035.

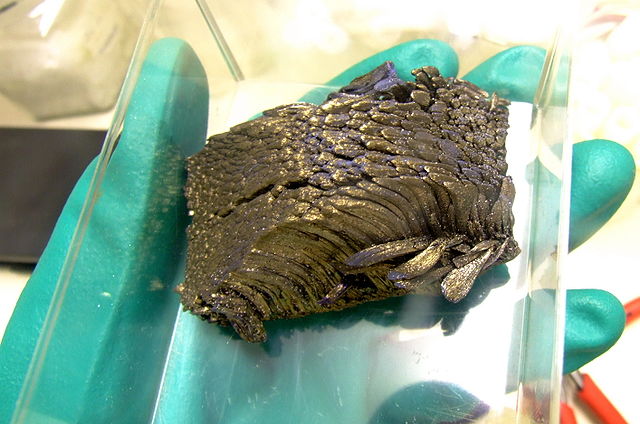

Rare earth elements and critical minerals play a key role in the production of green technologies like hydrogen fuel cells, wind turbines, solar panels and electric vehicles. The DOE says coal and waste from coal production contain an assortment of REE that can be extracted for components in those products.

“President Biden’s Investing in America agenda is providing a historic opportunity to convert coal products into the critical materials needed to build an array of clean energy products,” said Jennifer M. Granholm, U.S. Secretary of Energy.

Approximately 80 per cent of REE utilized in the U.S. are imported from international suppliers. The facilities being developed through the funding will process and extract rare earths from 250 billion tons of coal reserves, 4 billion tons of coal waste and 2 billion tons of coal ash from various locations throughout the country.

Read more: Government of Canada establishes $1.5B fund for critical minerals projects

Read more: Idaho Strategic Resources discovers high grade rare earth elements in Idaho

Canada is also focused on REE and critical minerals

Canada established a $1.5 billion fund last year for domestic critical minerals and REE projects. The U.S. and Canada partnered to develop a joint critical minerals strategy at the end of March to reduce dependence on China for the commodities and strengthen their combined electric vehicle supply chain.

Through the partnership, the U.S. will be investing US$250 million in domestic and Canadian companies involved in producing and processing critical minerals.

In addition to their use in low-carbon power sources, REE are utilized in electronics, satellites, computers and an assortment of other technology. The number one use for the elements globally is magnet production, which accounted for 43 per cent of their global demand in 2021 — according to Natural Resources Canada.

China produces more rare earths than any other country.

Companies involved with REE in the U.S. include American Rare Earths (ASX: ARR) (OTCQB: ARRNF), owner of the 6,866-acre La Paz project in Arizona producing praseodymium and scandium; MP Materials Corp. (NYSE: MP), operator of the Mountain Pass open-pit rare earth mining operation; and Idaho Strategic Resources, Inc. (NYSE: IDR), owner of the Lemhi Pass, Diamond Creek and Mineral Hill REE projects.

rowan@mugglehead.com