Bayhorse Silver Inc (CVE: BHS) (OTCMKTS: BHSIF) (FRA: 7KXN) was able to recover 99.9 per cent of the antimony from a concentrate produced at its mine site on the Oregon-Idaho border. Montana-based Allihies Engineering made this achievement possible with a proprietary extraction method.

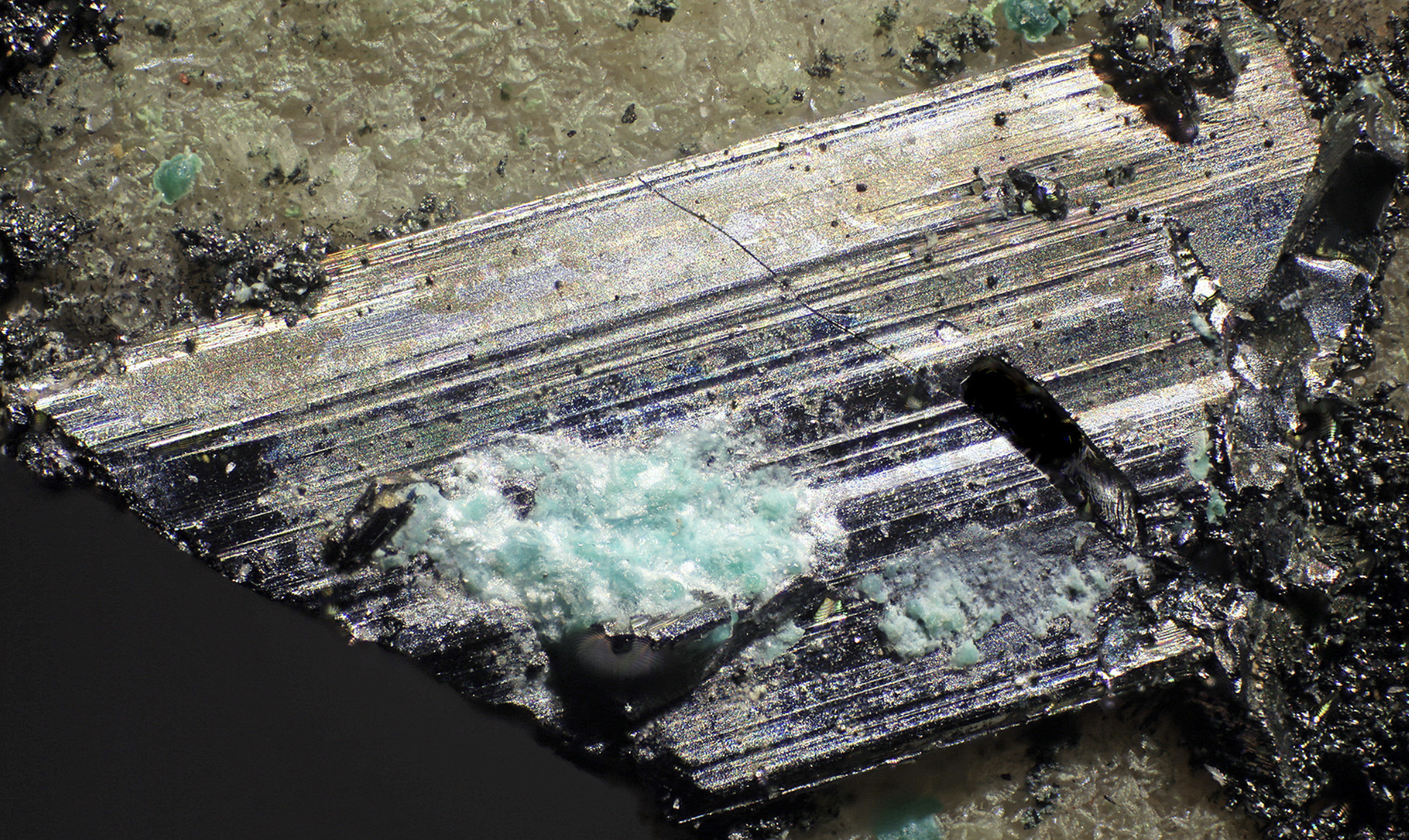

Bayhorse announced the positive development on Dec. 8. Notably, it was determined that the leachable antimony from the concentrate was in the form of skinnerite — a rare mineral composed of antimony and copper.

The concentrate sample held 5.85 per cent antimony alongside significant copper and zinc mineralization.

“The company has researched effective leaching methods on the ‘refractory’ Bayhorse critical minerals for over 10 years in order to get better silver and copper recovery,” chief executive Graeme O’Neill explained.

“Now, with these significant selective antimony leaching results breaking down the refractory nature of the mineralization, all of the silver, copper antimony and zinc mineralization may be readily separated with much better recoveries and can become payable, with the antimony shipped as a separate payable material.”

Bayhorse says that Allihies has now demonstrated the economical antimony recovery capability of its technique. Furthermore, Bayhorse is considering establishing a pilot-scale antimony leaching facility that would use this technique to extract antimony from a stockpile of concentrate the company currently holds.

Additionally, the achievement is highly significant because it demonstrates that antimony and copper can be efficiently separated from the skinnerite they are contained in a cost-friendly manner. Much of the mineralization at the Bayhorse Mine comes from this type of mineral.

Read more: NevGold expands high-grade antimony discovery at Nevada’s Limousine Butte Project

Upcoming silver production to improve Bayhorse’s balance sheet

As is evident from the company’s name, Bayhorse is primarily focused on silver mining. The company is expecting to have an operating permit in hand for its flagship mine in eastern Oregon in mid-2026.

Bayhorse says it will be capable of producing up to 640,000 ounces of the precious metal annually once operations ramp up in early 2027. Silver just continued its climb to historic heights by ascending over US$60 per ounce.

Moreover, the United States Geological Survey now considers silver and copper to be critical minerals essential for national security.

Bayhorse’s current debt-to-equity ratio is very high, sitting at approximately 503 per cent. Despite this negative detail, the junior has seen a sharp share price increase over the past couple of months and elevated trading volume. This reflects speculative interest in high-value critical minerals like antimony leading up to planned production in early 2027.

This momentum isn’t unique to Bayhorse. Fellow American junior NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50) recently reported favourable antimony recoveries at its top project.

Read more: NevGold surges after closing C$10M financing deal

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com