European vehicle makers are very upset about the shortage of rare earth magnets needed on their production lines.

China’s decision to implement export controls on several rare earth elements in April has sent shockwaves through the automotive industry. The nation has maintained a monopoly on the commodities for years and is now making its industry dominance felt even more in response to tariff measures implemented by Donald Trump.

In an interview with Reuters on Monday, the CEO of Germany’s magnet producer Magnosphere said he has been answering multiple calls from stressed out automaker and part supplier officials desperate to find new sources of the materials.

“The whole car industry is in full panic,” said Frank Eckard. “They are willing to pay any price.”

Many of these auto industry workers say their factories could be brought to a standstill by mid-July at this rate. A few have already shutdown for the foreseeable future, according to the European Association of Automotive Suppliers (CLEPA).

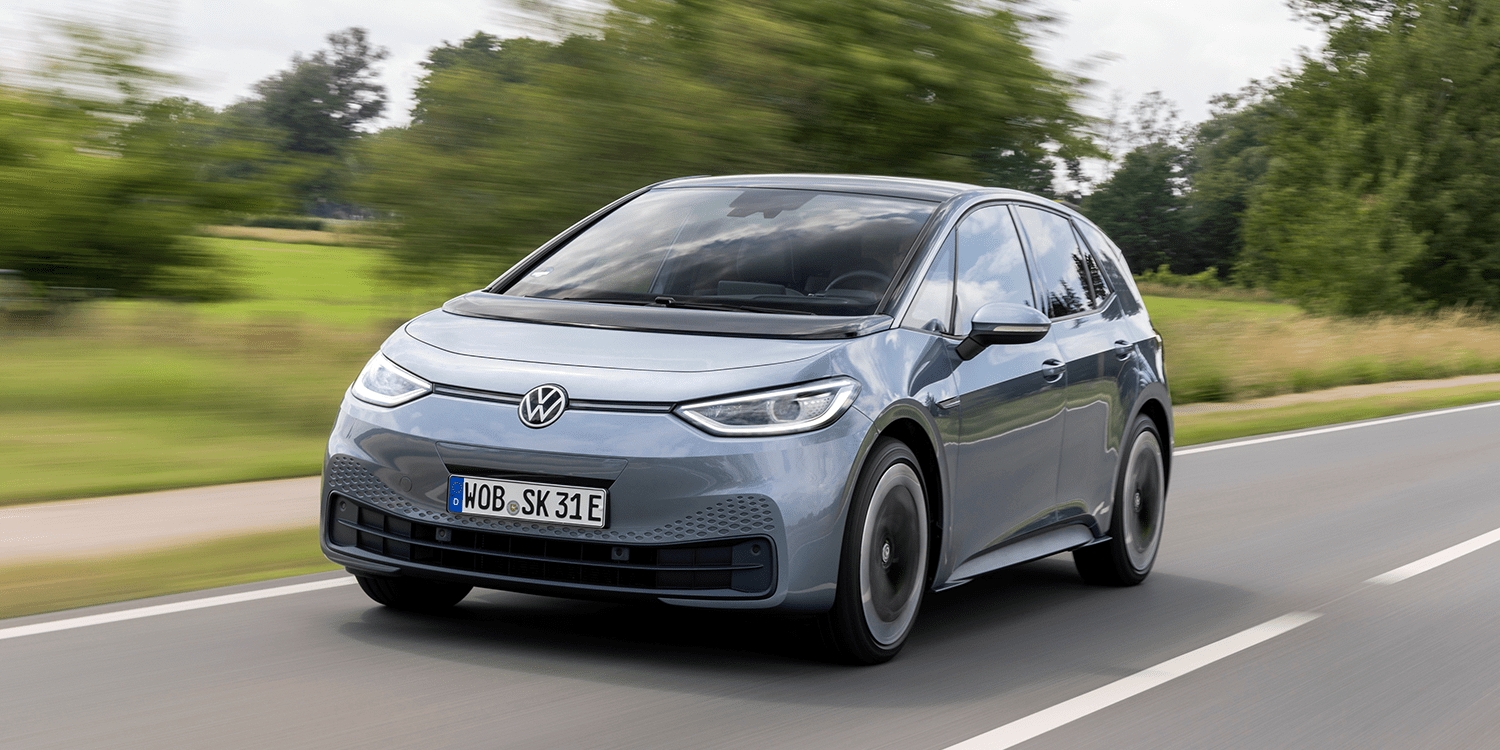

China currently produces a whopping 90 per cent of the rare earth magnets needed in the automobile supply chain. The rare metals are essential components for motors, brakes and steering assemblies — particularly in electric vehicles. The average EV uses about half a kilogram of rare earths.

Now, automakers in Europe and abroad are scrambling to try and obtain export permits from China, find other sources of the elements and reduce their consumption. Hundreds of applications have been sent to the Chinese and only so many will receive approval.

Major vehicle companies like Bayerische Motoren Werke A G Unsponsored ADR (OTCMKTS: BMWKY) (ETR: BMW) and General Motors Co (NYSE: GM) (ETR: 8GM) have been working to create motors that don’t require neodymium, dysprosium or praseodymium, but they are still in the early stages of development.

For three decades, China has been building an effective monopoly on rare earth elements and high-strength permanent magnets. That monopoly is about to hit European automakers hard. Why? Without Chinese magnets, they can’t build EVs. #china #ev #electricvehicle #alternativeenergy… pic.twitter.com/9c9NYg2RLC

— Robert Bryce (@pwrhungry) May 28, 2025

Read more: NevGold pulls up even more promising antimony grades from Nevada property

Chinese and American officials meet again in London

European automakers are not the only ones hit hard by the restrictions. American automobile manufacturers are currently struggling to find solutions for their unfortunate situation. Chinese exports to the U.S. in May declined by 34.5 per cent year-over-year.

Following successful talks in Geneva resulting in the nations agreeing to a tariff truce last month, the two countries met again in the United Kingdom on Monday. Despite China’s export controls remaining in place for now, the Swiss meeting was a step forward.

“We want China and the United States to continue moving forward with the agreement that was struck in Geneva,” said White House Press Secretary Karoline Leavitt on Sunday.

The rare earths bottleneck was a key topic of discussion among the delegations this week as the diplomatic chats resumed. They will continue on Tuesday.

One of the key goals for the Americans in the coming days is to convince the Chinese to put an end to the rare earth export controls, thereby alleviating stress in Europe as well.

“We want the rare earths — the magnets that are crucial for cell phones and everything else [EVs] — to flow just as they did before the beginning of April,” said U.S. National Economic Council Director Kevin Hassett, “and we don’t want any technical details slowing that down.”

Nonetheless, Trump says that negotiations are progressing. “We are doing well with China,” the president said Monday.

*US, CHINA HOLD TRADE TALKS IN LONDON: XINHUA

*THE MEETING IS EXPECTED TO EXTEND INTO THE UK EVENING AND MIGHT SPILL INTO TUESDAY

🇺🇸🇨🇳 pic.twitter.com/ZLwSnKSqGl

— Investing.com (@Investingcom) June 9, 2025

Read more: NevGold raises $5.5M for promising gold-antimony prospects in Nevada

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com