Au Gold Corp (CVE: AUGC) has entered into an agreement to acquire the Havelock Gold Antimony Project in Victoria, Australia, from Leviathan Gold Australia, a wholly owned subsidiary of Leviathan Metals Corp (CVE: LVX) (OTCMKTS: LVXFF).

Au Gold agreed to pay CAD$75,000 in cash and issue 5 million common shares to acquire the project last Monday. The company will also make per ounce payments tied to future resource definition.

The 11,663-hectare Havelock property sits in the heart of the Victorian goldfields, roughly midway between Bendigo and Ballarat, two of Australia’s most prolific historic gold producing districts.

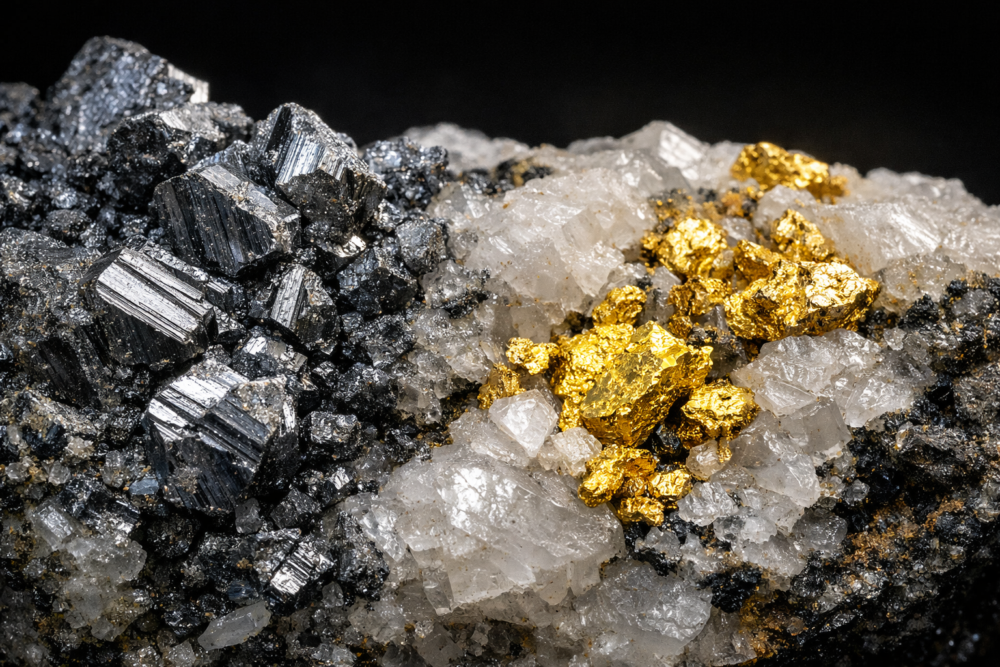

Havelock hosts multiple shallow, undrilled epizonal and mesozonal gold targets with reported antimony associations. Historic underground workings across the property recorded gold grades ranging from 1 to 10 ounces per ton during late 19th century campaigns.

Management showed antimony occurrences within historic workings as a potential vector toward epizonal gold mineralization.

The project also includes areas of documented coarse alluvial gold and benefits from paved road access and year round exploration conditions.

Two gold bearing structural corridors cross the property. The Shaw McFarlane Trend extends roughly 9 kilometres and hosts numerous historic workings, many of which have never been drill tested. Historic mining along this trend reached depths of about 152 metres before groundwater and technical limitations halted operations.

A second corridor, the Leviathan Mariner’s Trend, covers approximately 3 kilometres. Leviathan completed an eight hole diamond drilling program along a 270 metre segment of this trend in 2021, with four holes returning results the vendor described as warranting further work.

Read more: NevGold targets U.S. critical mineral supply chain with new antimony-gold find

Read more: NevGold Expands Gold-Antimony Potential at Limousine Butte in Nevada

Au Gold to pay CAD$3 per ounce

In one notable modern anecdote, a 2010 dam excavation along the Shaw McFarlane Trend reportedly yielded 514 ounces of gold recovered by a metal detector operator from spoil material. The company cautioned that the selectively recovered samples do not represent the broader system.

Historic underground mining on the property was limited to depths of approximately 500 feet on the Shaw McFarlane Trend and 900 feet on the Leviathan Mariner’s Trend. Comparable epizonal and mesozonal systems elsewhere in Victoria extend beyond 1,000 metres, suggesting potential beneath historic workings.

Experts believe the gold systems formed during the Late Devonian period. Regional age dating indicates intrusive activity contemporaneous with gold mineralization within 10 kilometres of the property.

In addition to cash and equity consideration, Au Gold agreed to pay CAD$3 per ounce discovered in future measured, indicated, or inferred resources. The company will also honor an existing agreement requiring payments to Mercator Gold Australia of A$1 per ounce discovered and A$1 per ounce produced, each capped at A$1 million.

Au Gold has incorporated a wholly owned Australian subsidiary, Havelock Gold Pty Ltd, to hold the asset. It will assume an existing A$10,000 environmental bond.

The company stated there are currently no mineral resources defined on the property. It also cautioned that historic production does not guarantee future exploration success. Post closing, Au Gold plans to begin exploration activities on the project as soon as regulatory approvals are received.

Read more: NevGold surges after closing C$10M financing deal

Read more: NevGold expands high-grade antimony discovery at Nevada’s Limousine Butte Project

Export contorls have pushed antimony into rare earth category

Antimony is a silvery gray metalloid that rarely attracts public attention, yet it plays a quietly critical role in modern industry, defense, and energy systems. It is brittle, resistant to corrosion, and has unique flame retardant and alloying properties. On its own, antimony is seldom used in pure form. Instead, it is blended with other materials to enhance hardness, durability, and thermal stability.

Companies commonly use antimony in flame retardants, and more specifically antimony trioxide. Antimony trioxide is combined with halogenated compounds to slow or suppress combustion. This makes it essential in plastics, textiles, electronics housings, aircraft interiors, and military equipment. Companies frequently use antimony in lead acid batteries, where it strengthens lead plates and improves cycling performance. Other uses include semiconductors, ammunition, infrared optics, and certain types of glass and ceramics. In short, antimony sits at the intersection of civilian manufacturing and national security.

The recent surge in interest around antimony is geopolitical, not cyclical. China is responsible for the majority of mined production and downstream processing. That concentration has become increasingly uncomfortable for Western governments as strategic competition has intensified.

Export controls, supply chain weaponization, and trade disputes have pushed antimony into the same category as rare earths, gallium, and germanium. Defense planners view it as a vulnerability. Militaries around the world require antimony for munitions, flame resistant materials, and energy storage systems. Supply security, however, is far from guaranteed. At the same time, demand is rising from electrification, grid storage, and stricter fire safety standards in buildings and vehicles.

The result is a classic strategic squeeze: rising demand colliding with politically constrained supply.

Read more: NevGold expands Limo Butte footprint by staking 90 promising antimony-gold claims

Read more: NevGold’s latest discovery represents near-term antimony production potential

FAST 41 will not guarantee approval

The United States has responded by treating antimony as a strategic mineral, even if it rarely makes headlines. Federal agencies have prioritized domestic and allied supply chains through permitting reform, capital support, and direct intervention.

One key mechanism is the Fast 41 framework, a federal initiative designed to accelerate permitting for strategically important infrastructure and mining projects. While Fast 41 does not guarantee approval, it compresses timelines and forces inter agency coordination, critical for minerals projects that historically languished for years.

The U.S. has also taken more direct action. Through agencies such as the Department of Defense and the Development Finance Corporation, Washington has begun buying equity stakes and providing financing to critical minerals companies, including those focused on antimony. This approach mirrors Cold War era stockpiling logic, but updated for modern capital markets.

For junior and mid tier mining companies, the lesson is clear: geology alone is no longer enough. Firms seeking U.S. government attention are reshaping their narratives around security of supply, jurisdictional safety, and downstream relevance.

That includes emphasizing domestic or allied nation projects, highlighting antimony as a co product rather than a footnote, and aligning exploration plans with defense and energy priorities. NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50) is one example of a company that has elevated antimony alongside gold in its messaging, framing the metal as strategically significant rather than merely ancillary. This kind of positioning increases the odds of attracting institutional, and potentially state linked, capital.

Read more: GoldMining chooses to retain its NevGold shares for next 18 months

Read more: NevGold delivers major growth at Idaho gold project

Multiple countries incorporate critical minerals into national policy

More countries outside the United States are pushing to secure antimony. Australia has explicitly incorporated critical minerals into national policy, offering grants, streamlined permitting, and federal backing for projects tied to defense and clean energy. Companies are now assessing antimony bearing systems in Victoria through a strategic lens rather than a purely commercial one.

The European Union has taken a similar approach, placing antimony on its critical raw materials lists and encouraging domestic production and recycling. Japan and South Korea, heavily dependent on imports, have pursued long term offtake agreements and overseas equity investments to reduce exposure.

.

NevGold Corp is a sponsor of Mugglehead news coverage

.