AMC Robotics Corporation (NASDAQ: AMCI), an American firm specializing in AI-powered autonomous robotics and intelligent security solutions, entered the public markets last week through a special purpose acquisition company merger. Their business combination is a significant milestone in AMC’s evolution from a private security tech firm to a listed entity.

In mid-December trading sessions, AMC shares have spiked as much as 170 per cent at the intraday peak. Pre-market surges exceeding 18 per cent and high volume have underscored investor optimism about the tech operator’s AI-powered quadruped security niche.

This momentum since the company’s public debut on Dec. 10 has made the stock one of the most discussed on Stocktwits and other popular trading insights platforms.

The rally marked a substantial turnaround from a near 30 per cent plunge on the robotics operator’s first trading day. It has been on the up and up since this initial slump with speculative trading and a bullish outlook among investors fuelling gains. AMC’s bull run coincides with broader enthusiasm in the AI and robotics space amplified by Tesla Inc (NASDAQ: TSLA) Optimus robots, successes achieved by others such as Ubtech Robotics Corp Ltd (OTCMKTS: UBTRF), and policy tailwinds favouring tech innovation.

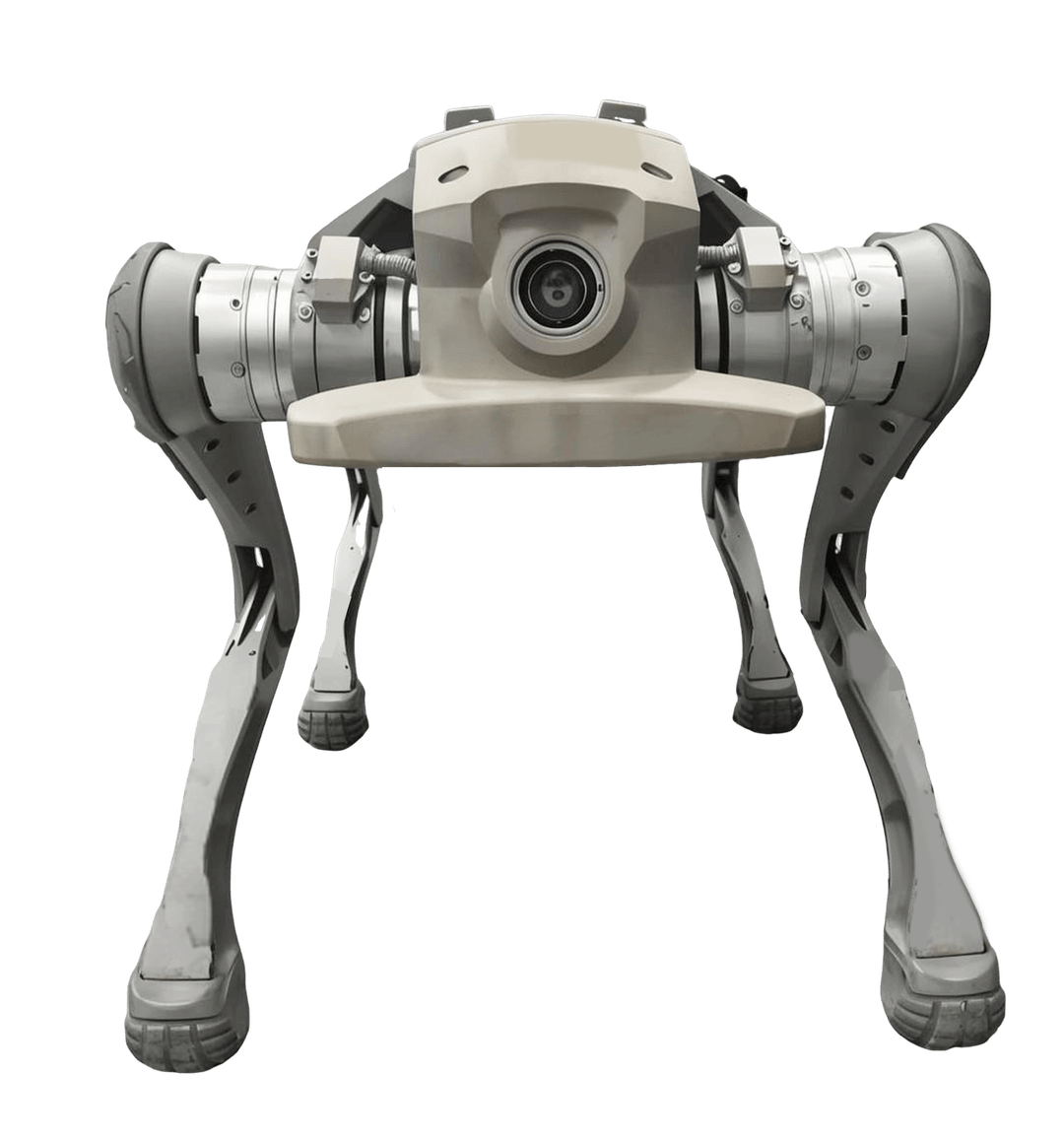

AMC specializes in quadruped/dog-style robots that are used to patrol warehouses and industrial facilities. These AI-integrated machines are capable of performing systematic surveillance, real-time anomaly detection and incident response. They will complete thorough photo and video documentation of any irregularities and notify authorities.

“The robot can perform autonomous patrols along predefined or AI-optimized routes without relying on remote control,” AMC explained on its website. “When fixed-position cameras detect suspicious activity, the backend system can dispatch the AI security quadruped robot to the location for real-time monitoring.”

Equity obtained through the public listing will enable AMC to accelerate commercialization of its robotic tech.

“With the launch of our AI-powered robotic technology, we have an opportunity to capture share in the warehousing market and drive long-term growth,” said CEO Sean Da in a press release on Dec. 10.

Nonetheless, AMC’s status as a small-scale company with a limited workforce and reliance on equity financing for growth makes it a relatively high-risk investment prospect. Its stock is prone to extreme volatility at the moment. The tech creator’s balance sheet shows a mix of considerable assets and significant liabilities.

United States-based AMC was founded in 2014. It originally focused on security solutions before pivoting to advanced robotic tech. Aside from quadrupeds, AMC is also renowned for its YI-branded high-definition security cameras.

Read more: Viral clip shows alleged spy robot at Indian-Chinese border

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com