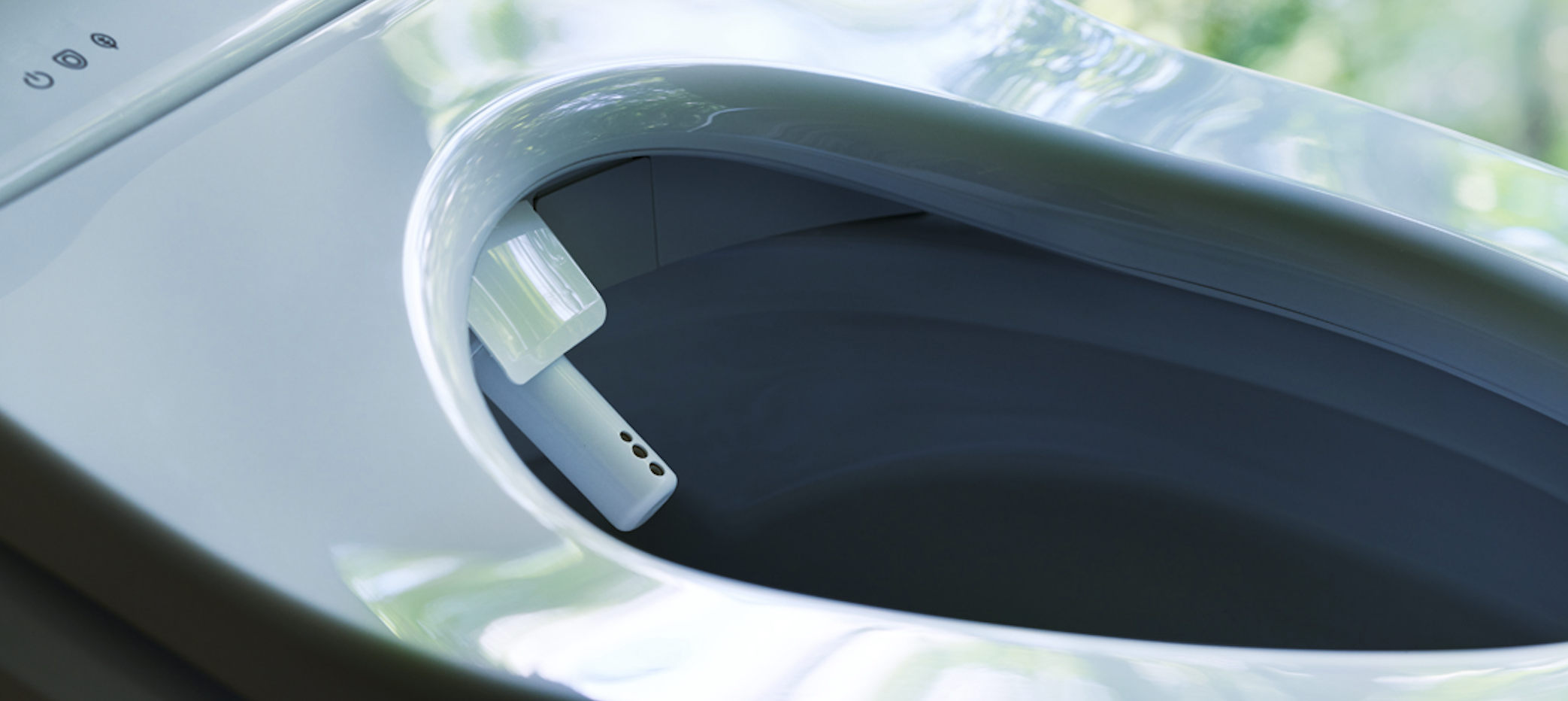

British hedge fund Palliser Capital released a report this week declaring that leading Japanese toilet tech producer TOTO Ltd (OTCMKTS: TOTDF) (TYO: 5332) is the “the most undervalued and overlooked AI memory beneficiary.”

The United Kingdom-based firm, a top 20 shareholder in TOTO with an undisclosed interest, says that harnessing the company’s artificial intelligence potential could unlock a 55 per cent boost in its share price.

Palliser argues TOTO trades at a ¥554 billion (US$3.6 billion) value gap due to under-appreciation of its Advanced Ceramics segment, which generates over 50 per cent of operating profits. This unit of TOTO makes special ceramic pieces called electrostatic chucks. They use electricity to grip silicon wafers tightly and evenly while machines carve the tiny patterns needed to build modern “NAND” memory chips used in AI data centres, in a nutshell.

Escalating demand for artificial intelligence infrastructure and the company’s special capabilities have prompted Palliser to predict that TOTO’s revenue will grow by over 30 per cent annually in the years to come. Moreover, the price of NAND chips has risen dramatically due to ballooning AI requirements, ascending by roughly 200 per cent within the past year.

Strong partnerships, such as a significant component supply agreement with major chip-tool maker Lam Research Corp (NASDAQ: LRCX) (ETR: LAR0) and the fact that the industry is rapidly shifting to chips with 200 or more layers, should also serve as growth catalysts. More layers equals chips that can hold more data, essentially. The percentage with this number of layers has risen by around 40 per cent in the past two years.

TOTO shares surged by more than 9 per cent on the OTC Markets Tuesday after the report dropped. This reaction builds on gains in excess of 60 per cent within the past year.

Palliser has blamed TOTO’s undervaluation on limited disclosure of its Advanced Ceramics segment. Only one page in recent investor materials covers this topic, the firm has highlighted. Furthermore, the hedge fund says insufficient capital is being allocated to it, with only 11 per cent of TOTO’s US$370 million in fiscal 2025 investments being put toward the unit.

Read more: Elon Musk insists the next frontier for AI is above the atmosphere

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com