American Tungsten & Antimony Ltd (OTCMKTS: ATALF) (FRA: 4VZ) is celebrating production of its first antimony ingots this week.

From stockpiled ore at its Antimony Canyon Project in Utah, the company turned raw material into polished metal bars at an independent metallurgical lab.

The development follows the company’s rebrand in late 2025, ditching the old Trigg Minerals name to spotlight its American tungsten and antimony ambitions.

At Antimony Canyon, the site is loaded with ready-to-process stockpiles from past mining days. Testwork on these stockpiles made delivery of the antimony ingots possible.

Moreover, the junior miner recently delineated a high-grade deposit through drilling with potential for approximately 200,000 tons of contained antimony. This quantity could potentially sustain operations for over 20 years, thereby serving as incentive for the company establishing a smelter.

This achievement is important in the current environment because antimony is essential for modern defence products, solar tech and batteries that are in high demand. Decades without major domestic output have left the U.S. scrambling for at-home supply as Chinese export curbs continue to pose a threat to national security.

American Tungsten & Antimony plans to keep churning out more bars from its stockpiles and is pursuing a Nasdaq listing by the end of this year’s second quarter. To amplify the importance of the ingots, the antimony producer highlighted in a news release on Feb. 5 that its chairman would be heading to Washington D.C. next week to meet with government stakeholders.

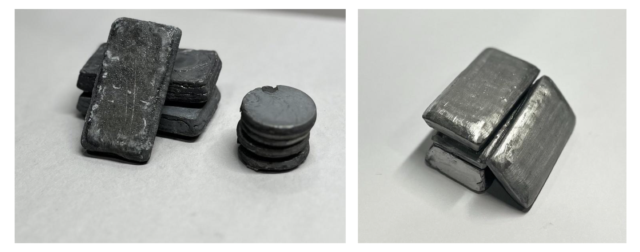

Unpolished and polished antimony ingots. Image credit: American Tungsten & Antimony

Read more: NevGold Corp. advances toward gold-antimony resource with expanded Nevada drilling

One of a select few producing American antimony ingots

The junior operator is one of a small but growing chorus of U.S. antimony players leading the industry.

Another one of these, Locksley Resources Ltd (OTCMKTS: LKYRF) (ASX: LKY) (FRA: X5L), pulled attention in October by unveiling what it hailed as the first 100 per cent American-made antimony ingot. It was produced from ore at the Mojave Desert mine in California.

Meanwhile United States Antimony Corp (NYSEAMERICAN: UAMY), a veteran operator, runs the country’s main smelter in Montana. It cranks out metal from mixed feeds and is ramping up aggressively this year under a massive government antimony ingot supply contract worth up to US$245 million.

Explorers are keeping the energy high in the sector too. NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50), for one, is drilling into promising gold-antimony zones at its Limo Butte project in Nevada. The explorer has hit high grades and posted strong metallurgical recoveries of up to 85 per cent for antimony in oxide material while eyeing near-term leverage from historical leach pads.

American Tungsten & Antimony’s first antimony ingots represent a practical step forward in rebuilding domestic production capacity for a critical mineral essential to U.S. defence and energy needs. Its contributes to a broader effort among companies in the industry like these that are working to strengthen supply chain security.

Read more: NevGold’s latest discovery represents near term antimony production potential

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com