In a national security-focused move this month, the National Bank of Poland has chosen to obtain another 150 tons of gold. This latest quantity obtained by the banking house will be worth almost US$23 billion. Officials did not specify how long it would take to procure the vast amount.

The decision builds on the bank’s already immense precious metal holdings, which currently exceed the European Central Bank. Narodowy Bank Polski has 550 tons in its possession at the moment, worth approximately €65 billion.

Currently, Poland sits in spot number 12 on the list of the world’s top gold holders. It trails behind nations like the Netherlands and Turkey. Once the Polish financial institution has the latest 150 tons in hand, it will rank within the top 10.

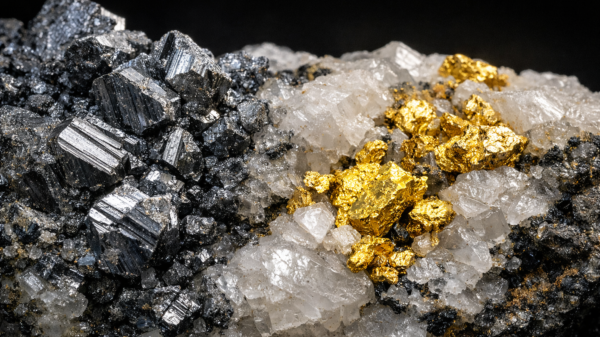

Poland’s progression is representative of an intentional strategy to treat gold as a cornerstone of domestic stability. Bank officials perceive the asset as being immune to external manipulations or freezes.

“NBP considers gold as a key element of financial security,” the bank said earlier this month.

Over the past decade, Poland has steadily built up its gold holdings. In 2016, the nation’s official banking house only held about 102 tons. Last year alone, the bank added 100 tons to its stock, thereby making Poland the number one buyer among central banks in 2025.

On a broader scale, the country’s actions are part of a prevalent trend where central banks have ramped up their rate of gold purchases amid global uncertainty, concerns about the American dollar and growing safe haven appeal. Financial institutions in nations such as Brazil, Kazakhstan and Uzbekistan have mirrored Poland’s enthusiasm to varying extents.

Reducing exposure to credit risks associated with foreign bonds and maintaining independence in monetary policy are other incentives for gold spending among major finance institutions.

As of early 2026, the United States, Germany, Italy, France and Russia are the world’s top five gold holding nations, respectively. The Americans lead with over 8,100 tonnes while Russia sits at the bottom of the handful with 2,330 tonnes. Below Russia you will find China, India, Switzerland and Japan.

Read more: NevGold’s latest discovery represents near-term antimony production potential

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com