New York financial firm Oppenheimer & Co. Inc. just initiated coverage of Serve Robotics Inc (NASDAQ: SERV). The financial services provider has a highly bullish outlook for the food delivery robot creator.

In a report on Dec. 18, Oppenheimer gave Serve a share target of US$20 — nearly twice as high as the stock’s current price. This target coincides with an outperform rating from the firm. Serve stock rose by approximately 6 per cent Thursday on the back of the news.

“We see Serve Robotics as a Physical AI pioneer targeting last-mile delivery as its first application,” said Oppenheimer Managing Director and analyst, Colin Rusch.

“We believe it is leveraging its global data leadership in complex environments, notably sidewalks, into advantaged hardware design and software efficiency to drive structural cost advantages and accelerated learning cycles versus peers.”

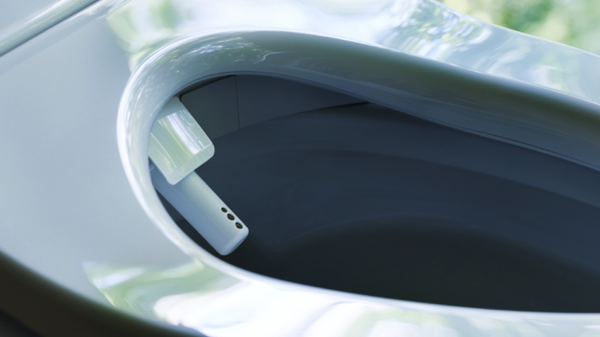

Serve Robotics announced earlier this month that it has deployed 2,000 robotic food transport bots throughout major cities in California, Georgia, Texas, Illinois and Virginia. This fleet has expanded twenty-fold throughout 2025.

The robots are capable of making food runs throughout challenging metropolitan terrain with a 99.8 per cent success rate, Serve says.

Serve reported a 210 per cent year-over-year revenue increase in Q3 at US$687,000 because of a rapidly increasing number of robots on the streets and grub deliveries. Though modest, the sum shows that Serve has been scaling up its operations.

In another significant development, the food delivery tech developer initiated a multi-year partnership with DoorDash Inc (NASDAQ: DASH) (FRA: DD2) on Oct. 9. Initial deliveries through the collaboration began in Q4.

In August, Serve completed its takeover of artificial intelligence and robot navigation specialist Vayu Robotics. This merger has enabled Serve’s zero-emission delivery bots to complete deliveries more safely and efficiently.

Serve was spun out from Uber Technologies Inc (NYSE: UBER) (LON: 0A1U) as an independent entity in 2021. Uber Eats and Serve currently maintain a major commercial agreement. The vast majority of Serve’s third quarter revenue was attributable to this long-standing partnership.

Serve takes pride in its four-wheeled machines never forgetting the ketchup. In Chicago last month, the company let an artist give one of the robots a makeover.

Chicago artist Emmy Star Brown gave Jolene a Chicago-style glow-up, transforming our delivery robot into a mural on wheels inspired by the city’s color and creativity.

Catch Jolene rolling through the neighborhoods, one joyful delivery at a time. pic.twitter.com/CRLrsMSORH

— Serve Robotics (@ServeRobotics) November 24, 2025

Read more: AMC Robotics shines on the Nasdaq after public debut

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com