Hut 8 Corp. (NASDAQ: HUT) (TSE: HUT) has agreed to a roughly USD$7 billion deal to lease and develop a massive data centre in Louisiana, accelerating its push into artificial intelligence infrastructure.

The company said Wednesday it will sign a 15-year lease to build a 245-megawatt facility at the River Bend campus.

Shares rose about 21 per cent in premarket trading, adding to an advance of roughly 80 per cent this year. Construction of the first phase is expected to finish by early 2027, according to the company.

Additionally, the move reflects a broader shift among former cryptocurrency miners toward hosting AI workloads. Companies such as CoreWeave Inc (NASDAQ: CRWV) and Applied Digital Corp. (NASDAQ: APLD) are repurposing energy-heavy sites once dedicated to bitcoin mining.

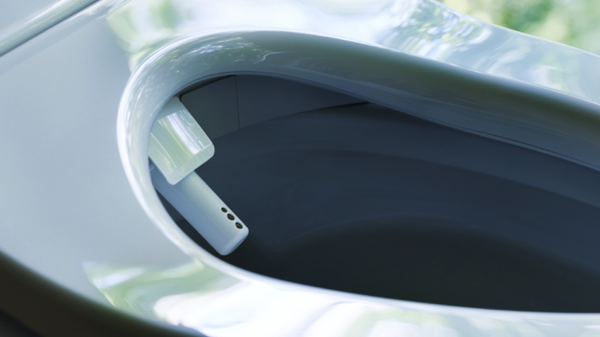

Meanwhile, those sites offer access to high-voltage power, advanced cooling systems and specialized real estate.

These assets are increasingly scarce as AI developers race to deploy Nvidia Corp. (NASDAQ: NVDA) graphics processing units.

Hut 8 has spent the past year transforming itself from a pure-play bitcoin miner into an energy infrastructure platform. Furthermore, the Louisiana project involves partnerships with AI model developer Anthropic and infrastructure firm Fluidstack.

Alphabet Inc. (NASDAQ: GOOGL), through Google, will provide a financial backstop for the 15-year lease term.

That support reflects the urgency among major cloud players to secure long-term capacity for power-intensive AI systems.

In addition, the agreement forms part of a collaboration between Hut 8 and Anthropic. That relationship could eventually scale to about 2.3 gigawatts of data centre capacity, the company said.

Last month, Anthropic disclosed plans to invest roughly USD$50 billion in data centres alongside Fluidstack.

Read more: Onslaught of junk AI content prompts Merriam-Webster to select ‘slop’ as its word of the year

Read more: McDonald’s pulls Grinchy AI-made Christmas ad after avalanche of complaints

Rising costs and tighter margins facilitate a new strategy

Meanwhile, Hut 8 reported a total power development pipeline of 8.65 gigawatts across North America. That pipeline ranges from early-stage site reviews to 1.53 gigawatts of late-stage projects under active development.

Hut 8 built its business around operating energy-intensive facilities that secure the Bitcoin network. However, rising costs and tighter margins pushed management to rethink that strategy.

Additionally, Hut 8 moved to separate its Bitcoin mining operations from its broader infrastructure ambitions. In 2024, the company carved out mining assets into a distinct entity to reduce risk and improve capital flexibility.

That restructuring allowed Hut 8 to focus on data centres, power development, and energy services. Meanwhile, the company entered a high-profile partnership tied to Eric Trump, a prominent business figure.

Eric Trump became involved through a U.S.-focused Bitcoin venture aligned with Hut 8’s mining spinout. The arrangement aimed to keep mining exposure while freeing Hut 8 to pursue higher-margin opportunities. Furthermore, many miners face structural pressure from soaring global Bitcoin hashrates.

As more machines come online, competition intensifies and rewards are spread thinner. Consequently, Bitcoin mining difficulty continues to climb, forcing operators to deploy more capital for the same output.

Electricity costs, hardware depreciation, and cooling expenses also weigh heavily on balance sheets. In addition, periodic Bitcoin “halving” events reduce block rewards, further squeezing profitability.

These factors have pushed companies to seek steadier revenue streams. Meanwhile, high performance computing offers long-term contracts and predictable cash flow.

AI and cloud customers pay premiums for reliable power, cooling, and secure facilities. Additionally, former miners already control the exact infrastructure those clients need. That overlap makes energy services and HPC hosting a natural evolution for firms like Hut 8.

.