Rare earth element yttrium has been in the spotlight this week. Supply constraints linked to China’s export controls are becoming increasingly concerning and its price has skyrocketed as a result.

This year alone, the rare metal’s dollar value has shot up by approximately 1,500 per cent to an all-time high of US$126 per kilogram. The commodity was worth a mere US$8 in late 2024, according to mining materials information firm Asian Metal.

The Chinese loosened export controls on certain commodities earlier this month after implementing strict restrictions on exports in April, but yttrium was not one of them.

Stakeholders in the aerospace, semiconductor and energy industries are currently ascending into panic mode as the element’s shortage and price are becoming impossible to ignore.

“China’s export controls have undoubtedly prompted a scramble for yttrium that continues several months on,” said rare earth trader and Argus analyst, Ellie Saklatvala, in a statement obtained by Reuters this week.

Exports leaving China to the U.S. have completely ceased since April and the rest of the world has seen a 30 per cent reduction in shipments from the Asian superpower. Historically, the Chinese have provided over 90 per cent of the yttrium supply for the Americans.

Furthermore, Argus data has shown that yttrium oxide prices have risen by 4,400 per cent in Europe since January at US$270 per kilo. Prices are much lower in the United States because of domestic stockpiling initiatives and emerging production. At the Mountain Pass mine run by Pentagon-backed MP Materials (NYSE: MP) in California, for instance, the company has been stockpiling the commodity for national security purposes. Additionally, American Resources Corp (NASDAQ: AREC) subsidiary ReElement Technologies is preparing to begin producing 200 tons per annum in December.

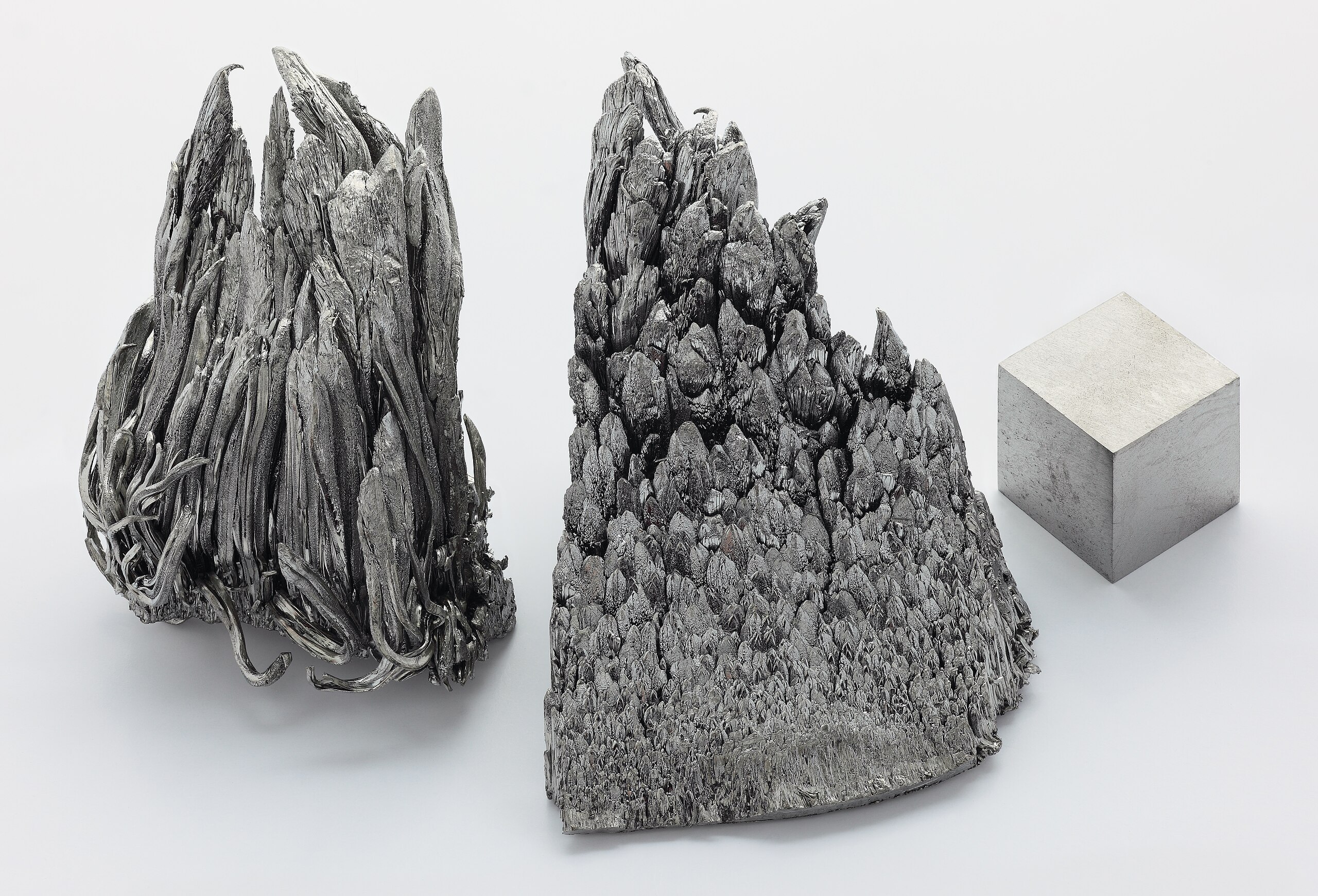

Yttrium is an essential component in advanced jet engine alloys, specialized ceramics, gas plant turbine blades, laser technologies and coatings used for temperature shielding. Also, protective coatings and insulators in semiconductors, which is highly significant.

Australian operator Lynas Rare Earths Ltd (OTCMKTS: LYSCF) (FRA: LYI) is currently preparing to ramp up yttrium production at its Mount Weld operation and processing plant in Malaysia to help meet global demands.

China’s Shenghe Resources Holding Co Ltd (SHA: 600392), Australia’s Iluka Resources Ltd (OTCMKTS: ILKAF) (FRA: ILZ) and Colorado-based Energy Fuels Inc (NYSEAMERICAN: UUUU) are other notable companies involved with yttrium mining and refining.

Read more: NevGold edges closer to gold-antimony resource with latest Limousine Butte results

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com