Canada’s Endeavour Silver Corp (TSE: EDR) (NYSE: EXK) (FRA: EJD) hit a 13-month high on Thursday after announcing the start of commercial production at a Mexican precious metals mine. It has been effective since Oct. 1, the multi-commodity producer specified.

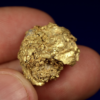

Long-term, the mine operator is expecting to produce 7 million silver equivalent ounces per annum at the Terronera project in the nation’s Jalisco state. The milestone comes at an opportune time as the price of silver and gold continues to rise. Silver hasn’t been this valuable since 2011 and gold is forecasted to potentially hit US$5,000 per ounce next year.

Terronera is expected to have a decade-long-life and has become the company’s flagship mining asset. It is known to have over 50 precious metal veins with widths ranging between 1 to 30 metres thick.

“Bringing Terronera into commercial production marks a huge milestone for Endeavour Silver and represents a truly transformational moment in our company’s history,” said CEO Dan Dickson in a news release on Oct. 16.

In a note on Thursday, an analyst from the National Bank of Canada (TSE: NA) (OTCMKTS: NTIOF) (FRA: NBC) said they had a positive outlook about the news.

“We expect Terronera to be a significant contributor to free cash flow generation and silver-equivalent production growth for Endeavour,” stated Alex Terentiew.

Terronera adds to a portfolio of three operational mines Endeavour currently runs throughout Latin America.

Silver production has been ongoing at Guanacevi, in Mexico’s Durango state, since 2005. It produced over 4 million ounces of silver last year and nearly 14,000 ounces of gold. Endeavour has described this site as the company’s first and highest grade silver mine.

Meanwhile, Endeavour continues to be involved with underground gold mining operations at the Bolañitos operation in Central Mexico and a gold-silver-zinc-lead site in Peru. Kolpa yielded over 2 million ounces of silver throughout 2024.

Endeavour’s market capitalization is currently sitting at approximately C$4 billion after a strong rally that has been ongoing since early last year.

In Q3, Endeavour sold more than 1.7 million silver ounces and nearly 7,500 gold ounces. Year-over-year, the company boosted its silver production by 102 per cent at 1.76 million ounces.

Endeavour attributes this production boost to the ramp up at Terronera and the addition of Kolpa through a US$145-million-dollar acquisition in May.

Despite the current momentum with precious metal pricing, Endeavour continues to deal with operational and cost pressures that mid-tiers typically face. These include inflation-driven expenses and Mexican permitting complexities.

A smooth continued ramp up to full-scale production at Terronera and success with operations at Kolpa will be key to continued share price gains going forward.

Silver just touched my initial target of $54 🔥🔥🔥

breaking through might be too much to ask for on this first try after a violent run, prefer to see some consolidation first retesting the monthly breakout ($48) which would be healthy for a prolonged advance into 2026 https://t.co/RDKaivEBPK

— Gold Ventures 🟡 (@TheLastDegree) October 16, 2025

Read more: NevGold targets U.S. critical mineral supply chain with new antimony-gold find

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com