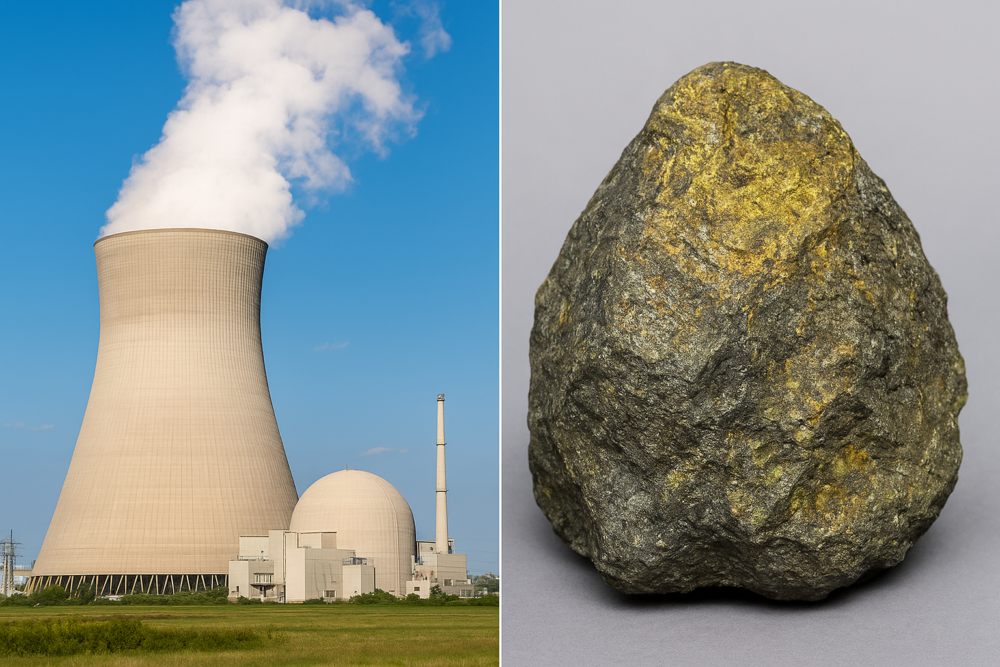

The uranium sector is experiencing renewed investor interest as global demand for nuclear energy intensifies.

Uranium provides a reliable, low-carbon fuel source for power plants worldwide. Consequently, companies involved in exploration, mining, and processing are gaining attention. Rising prices and tightening supply are also driving short-term gains across the market.

Several factors contribute to this trend.

Production constraints in major uranium-producing countries such as Kazakhstan and Canada have reduced available supply. In addition, governments, particularly in the United States, are implementing initiatives to strengthen domestic production. These policies support energy security and increase demand for U.S.-based producers. Furthermore, global interest in nuclear energy is growing as countries seek stable, low-carbon electricity.

Investors have taken note as stocks of leading companies have risen sharply in recent weeks.

Meanwhile, strategic contracts, acquisitions, and operational expansions further boost investor confidence. Companies that diversify into rare earth elements or enhance production capacity are especially well-positioned. Consequently, short-term gains reflect both fundamental market trends and company-specific developments.

Additionally, uranium producers emphasize operational efficiency and sustainability. In-situ recovery and high-grade mining techniques reduce costs and environmental impact. Furthermore, adherence to strict safety and environmental standards strengthens long-term viability. Conversely, companies that fail to maintain efficient operations risk losing investor support.

Here are five companies deeply embedded in this trend.

Read more: Japan turns nuclear waste into rechargeable batteries

Read more: F3 Uranium finds high radioactivity during summer drilling campaign in Saskatchewan

Cameco Corporation at the tip of the spear

Cameco Corporation (TSE: CCO) (NYSE: CCJ) is one of the world’s largest publicly traded uranium companies. Headquartered in Saskatoon, Saskatchewan, Canada, it focuses on exploration, mining, and processing. The company operates globally, with major assets in Canada, the United States, and Kazakhstan. Its operations supply nuclear power plants with the metal, which fuels low-carbon electricity production. Consequently, Cameco plays a significant role in the global push for clean energy.

Additionally, Cameco secured a long-term contract to supply uranium hexafluoride (UF6) to Slovakian energy company Slovenské elektrárne. This deal strengthens its presence in Europe and ensures steady revenue streams. In addition, the company completed the acquisition of Westinghouse Electric Company, a strategic move that expands its influence across the nuclear power sector. This acquisition positions Cameco as a key player not just in uranium supply but also in nuclear technology and services.

Furthermore, the broader uranium market has contributed to the stock’s gains. Supply constraints in major producing countries like Kazakhstan and Canada have tightened the global market. Meanwhile, growing nuclear energy adoption, driven by countries seeking reliable and low-carbon electricity, has increased demand. Consequently, Cameco benefits from both higher uranium prices and heightened investor sentiment.

Additionally, the company has maintained a focus on operational efficiency. Its Canadian mines, including McArthur River and Cigar Lake, rank among the highest-grade uranium deposits globally. This allows Cameco to produce uranium competitively while adhering to strict environmental and safety standards.

Read more: Cameco, Orano ink CAD$500M, 15-year deal with indigenous-owned Rise Air

Read more: Department of Energy inks deal with six companies for low-enriched uranium

Diversified investments into rare earths spurs enthusiasm

Energy Fuels Inc (NYSEAMERICAN: UUUU) (TSE: EFR) is a leading U.S.-based uranium mining company. Headquartered in Lakewood, Colorado, it specializes in the production of uranium and rare earth elements.

The company operates several key assets, including the White Mesa Mill in Utah, the Nichols Ranch ISR uranium project in Wyoming, and the Alta Mesa project in Texas.

Energy Fuels has many uranium supply deals outstanding with nuclear power plants in the United States and internationally, contributing to low-carbon energy production. Consequently, it plays a vital role in energy security and the clean energy transition.

The company has also recently diversified into rare earth elements. It began pilot-scale production of heavy rare earth element oxides at the White Mesa Mill. This expansion taps into growing global demand for rare earths, which are critical for technology and renewable energy applications. In addition, Energy Fuels has increased its uranium production to align with U.S. government efforts to strengthen domestic nuclear fuel supplies.

Furthermore, the broader uranium market supports the company’s momentum. Rising uranium prices, combined with supply constraints in major producing countries, have boosted investor confidence. Meanwhile, global interest in nuclear energy continues to grow, particularly as nations seek reliable and low-carbon power sources. Consequently, Energy Fuels benefits from favorable market dynamics and heightened investor attention.

Additionally, the company maintains a strong operational focus. Its White Mesa Mill is the only conventional uranium mill in the United States, giving Energy Fuels a strategic advantage. Furthermore, the company adheres to high environmental and safety standards, ensuring sustainable operations.

Read more: Denison Mines extends high-grade uranium at Gryphon

Read more: Denison Mines announces joint exploration venture with Cosa Resources

Denison provides specialized uranium mine management

Denison Mines (TSE: DML) (NYSE American: DNN) is a Canadian uranium exploration and development company headquartered in Toronto, Ontario. It focuses on advancing uranium projects in the Athabasca Basin of northern Saskatchewan, one of the world’s richest uranium regions. Denison also provides mine management and environmental services through its subsidiary, Denison Environmental Services. Consequently, the company plays a key role in supplying uranium for nuclear power, supporting low-carbon electricity production globally.

Investor interest has been driven by both company-specific developments and broader market trends. Primarily, Denison benefits from the ongoing rally in uranium stocks, fueled by rising nuclear energy demand and supply constraints in major producing countries such as Kazakhstan and Canada. In addition, the company’s Wheeler River project positions it for future growth. Wheeler River is one of the largest undeveloped uranium projects in the Athabasca Basin, and it offers high-grade deposits that can be mined efficiently.

Furthermore, Denison continues to strengthen its operational capabilities. Its subsidiary, Denison Environmental Services, provides specialized uranium mine management and remediation services. This allows the company to generate additional revenue streams while maintaining environmental stewardship. Meanwhile, Denison has engaged in strategic partnerships with other uranium producers and energy firms, further securing its market position.

Additionally, market dynamics contribute to short-term gains. The U.S. government’s push for domestic uranium production and stockpile expansion increases demand for reliable suppliers. Consequently, Denison stands to benefit from long-term contracts and government initiatives.

The Wheeler Camp in the Athasbasca Basin. Image via Denison Mines.

Governments worldwide are looking to nuclear power

Uranium Energy Corp. (NYSE: UEC) is a U.S.-based uranium mining and exploration company headquartered in Corpus Christi, Texas. It specializes in in-situ recovery (ISR) uranium production, development, and exploration projects across the United States, including Texas, Wyoming, and New Mexico. The company also engages in uranium trading and owns significant processing facilities. Consequently, Uranium Energy Corp. plays a key role in supplying nuclear fuel for clean, low-carbon electricity generation.

The company has accelerated production activities to align with U.S. government initiatives aimed at strengthening domestic uranium supplies. In addition, positive financial results have reinforced investor confidence. Strong revenue growth and efficient operational performance highlight the company’s capacity to meet rising demand.

Furthermore, Uranium Energy Corp. benefits from favourable uranium market conditions. Supply constraints in major producing countries, including Kazakhstan and Canada, have tightened global availability. Meanwhile, governments worldwide are emphasizing nuclear energy as a reliable and low-carbon power source. Consequently, uranium prices have risen, supporting the profitability of U.S. producers like Uranium Energy Corp.

Additionally, the company focuses on strategic operational efficiency. Its ISR projects allow low-cost uranium production with minimal environmental disruption. Furthermore, Uranium Energy Corp. maintains strict environmental and safety standards, ensuring sustainable operations. Its fully permitted Hobson Processing Facility enables the company to process and supply uranium efficiently to domestic and international markets.

Read more: Province of Alberta launches public consultation on nuclear power

Read more: UK nuclear site set for revival as fusion fuel and medical isotope hub

Production delays have constrained availability

Ur-Energy Inc. (NYSE: URG) is a U.S.-based uranium mining company headquartered in Littleton, Colorado. It focuses on in-situ recovery (ISR) uranium projects, primarily in Wyoming. Its key assets include the Lost Creek and Shirley Basin projects, both fully permitted and operational. Ur-Energy also owns processing facilities that allow efficient conversion of uranium into yellowcake for nuclear fuel. Consequently, the company plays an essential role in supplying uranium for low-carbon nuclear energy.

Investor interest has been driven by several factors. First, the company benefits from tightening global uranium supply. Production delays in Kazakhstan and Canada have constrained availability, driving prices higher. In addition, rising interest in nuclear energy globally has increased demand for uranium, supporting Ur-Energy’s growth prospects.

Furthermore, the U.S. government’s push to enhance domestic uranium production strengthens the company’s market position. Meanwhile, Ur-Energy’s strategic operations in Wyoming position it to meet this demand effectively. The company has accelerated production and optimized its ISR projects to ensure reliable output. Consequently, investors view Ur-Energy as a key supplier in a growing market.

Additionally, Ur-Energy emphasizes operational efficiency and sustainability. Its ISR mining method reduces environmental impact compared with conventional methods. Furthermore, the company maintains strict safety and environmental standards across all projects. This focus enhances long-term viability and investor confidence.

.