B2Gold Corp. (NYSEAMERICAN: BTG) has expanded its position in Founders Metals (CVE: FDR) (OTCMKTS: FDMIF) (FSE: 9DL0) by purchasing additional shares through the open market, raising its stake to about 6 per cent.

Announced on Tuesday, the move fulfills obligations under the companies’ Shareholder Agreement and secures B2Gold’s right to participate in future financings up to a maximum of 9.9 per cent ownership.

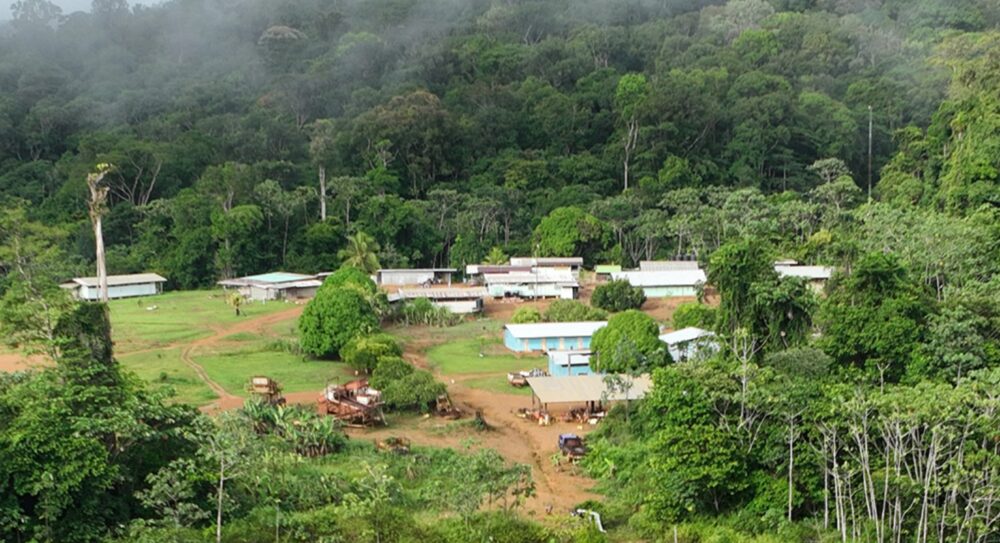

The investment highlights B2Gold’s confidence in Founders Metals and the Antino Gold Project in Suriname, which both firms describe as a potential Tier 1 discovery. Colin Padget, President and CEO of Founders Metals, said B2Gold’s continued involvement reinforces the shared belief in Antino’s long-term potential. He added that the support strengthens efforts to create value for shareholders as development progresses.

B2Gold’s portfolio includes the Fekola Mine in Mali, the Masbate Mine in the Philippines, the Otjikoto Mine in Namibia, and the Gramalote gold project in Colombia. Its track record in developing and operating large-scale mines adds weight to its backing of Founders.

Founders Metals, however, faces challenges. The company currently reports no revenue and operates with negative cash flow, which weakens its overall stock score. Technical analysis shows mixed signals with a bearish tilt, while ongoing valuation concerns stem from consistent losses. However, its strong balance sheet and recent corporate events offer optimism.

Significant financing and encouraging exploration results have positioned the company for potential upside if it can leverage these developments effectively. Additionally, B2Gold’s investment signals broader industry confidence, suggesting Antino could emerge as one of the most compelling new gold projects in South America.

Read more: NevGold closes its Nutmeg Mountain acquisition with Goldmining for $3 million

Read more: NevGold’s long intervals of antimony & gold mineralization turn heads

Analyst consensus is a moderate buy rating

Analysts view B2Gold with measured optimism. CIBC recently raised its price target from USD$3.60 to $4.00 while maintaining a neutral rating. Additionally, that target reflects an estimated 12 to 17 per cent upside. Canaccord Genuity reaffirmed a buy rating with a USD$5.61 target, implying nearly 44 per cent upside. Stifel Nicolaus and BMO Capital also maintained buy ratings, with targets near CAD$7.50. However, Bank of America continues to rate the stock a sell, citing weaker expectations.

Overall, consensus among analysts points to a moderate buy rating. The average 12-month target stands near CAD$6.11. In addition, some analysts highlight the company’s stable production profile and attractive dividend yield. Meanwhile, others remain cautious about rising costs and geopolitical risks across its operating jurisdictions. Further, a few upgrades suggest stronger confidence in long-term growth.

B2Gold continues to attract attention because of its balance between consistent production, exploration upside, and shareholder returns. However, analysts remain divided on the near-term outlook, with views ranging from sell to strong buy.

.