Trigg Minerals Ltd (ASX: TMG) (OTCMKTS: TMGLF) has received firm commitments from a group of investors for a private placement totalling approximately C$11.1 million. They will be receiving 147 million shares.

The sizeable sum will be used to propel the company’s Antimony Canyon project in Utah. This investment comes at a time when the United States is becoming increasingly focused on domestic sources of the critical mineral. A supply shortage resulting from China’s recently implemented export controls has become highly concerning for American government agencies and companies.

Alongside the Stibnite project under development by Perpetua Resources Corp (TSE: PPTA) (NASDAQ: PPTA) in Idaho and the Estelle operation run Nova Minerals Ltd (ASX: NVA) (OTCMKTS: NVAAF) (FRA: QM3) in Alaska, Trigg’s project is one of the most significant antimony resources in the U.S.

The United States is also home to promising antimony prospects advancing towards maiden mineral resource estimates, like the Limousine Butte project being developed by NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50).

Antimony Canyon is estimated to hold more than 100,000 tonnes of the metalloid, according to the Utah Geological and Mineral Survey. It is an essential component in multiple military technologies and weapons, telecom equipment, batteries, semiconductors, solar energy systems, flame retardants and other crucial goods.

Read more: NevGold’s latest Nevada drill results show exceptional gold mineralization

Private placement is a major milestone

Trigg’s Managing Director, Andre Booyzen, described the investment as transformational.

“The strong support from US and Australian investors, through the joint efforts of Roth Capital and GBA Capital [the lead placement managers], reflects growing recognition of Antimony Canyon as a near-term critical minerals project,” he highlighted in the ASX announcement.

In addition to exploratory mining activities at Antimony Canyon, funds will be utilized for prospecting work at the Achilles Antimony project in Australia. These projects share geological similarities.

At the Utah property, Trigg aims to validate historical data, delineate the full extent of the mineralization footprint and produce an updated mineral resource estimate in compliance with the Joint Ore Reserves Committee (JORC) Code. This code is a mandatory standard for ASX-listed miners.

Geological mapping, trenching, channel sampling and a targeted drill campaign commenced at the end of May. This newly secured funding will enable the ongoing work to progress smoothly.

“Antimony Canyon is strategically positioned to address urgent demand and support national supply chain resilience in the US, which currently does not produce any domestic antimony,” Trigg said on social media Tuesday.

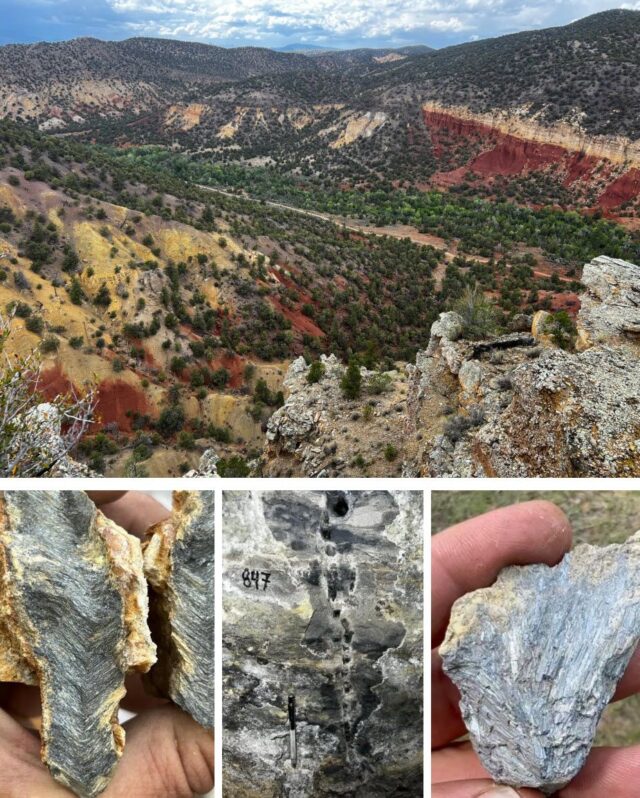

The Aussie mining company reported discovering extensive zones of stibnite mineralization at the site last month.

“Work is now underway to assess additional high-priority targets across and beyond historically defined limits,” the company said.

Stibnite mineralization, Antimony Canyon. Image credit: Trigg Minerals

Read more: NevGold’s latest drill results extend priority target at Limo Butte by over 200 metres

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com

Pattie Sorensen

July 9, 2025 at 12:32 pm

This may be a boon to the economy for Antimony. En vironmentalists will have a tizzy.but with all of the regulations

for mining. There are many safe guards in place