China’s decision to cut off its supply of antimony to the U.S. in December and impose restrictions on several other nations months prior has made the leading producer’s exports take a sharp decline.

On Monday, Fastmarkets commodities price reporter Xiaoying Du said that the country exported zero antimony metal throughout May while antimony trioxide shipments plummeted by over 83 per cent. Du cited new Chinese customs data for his report.

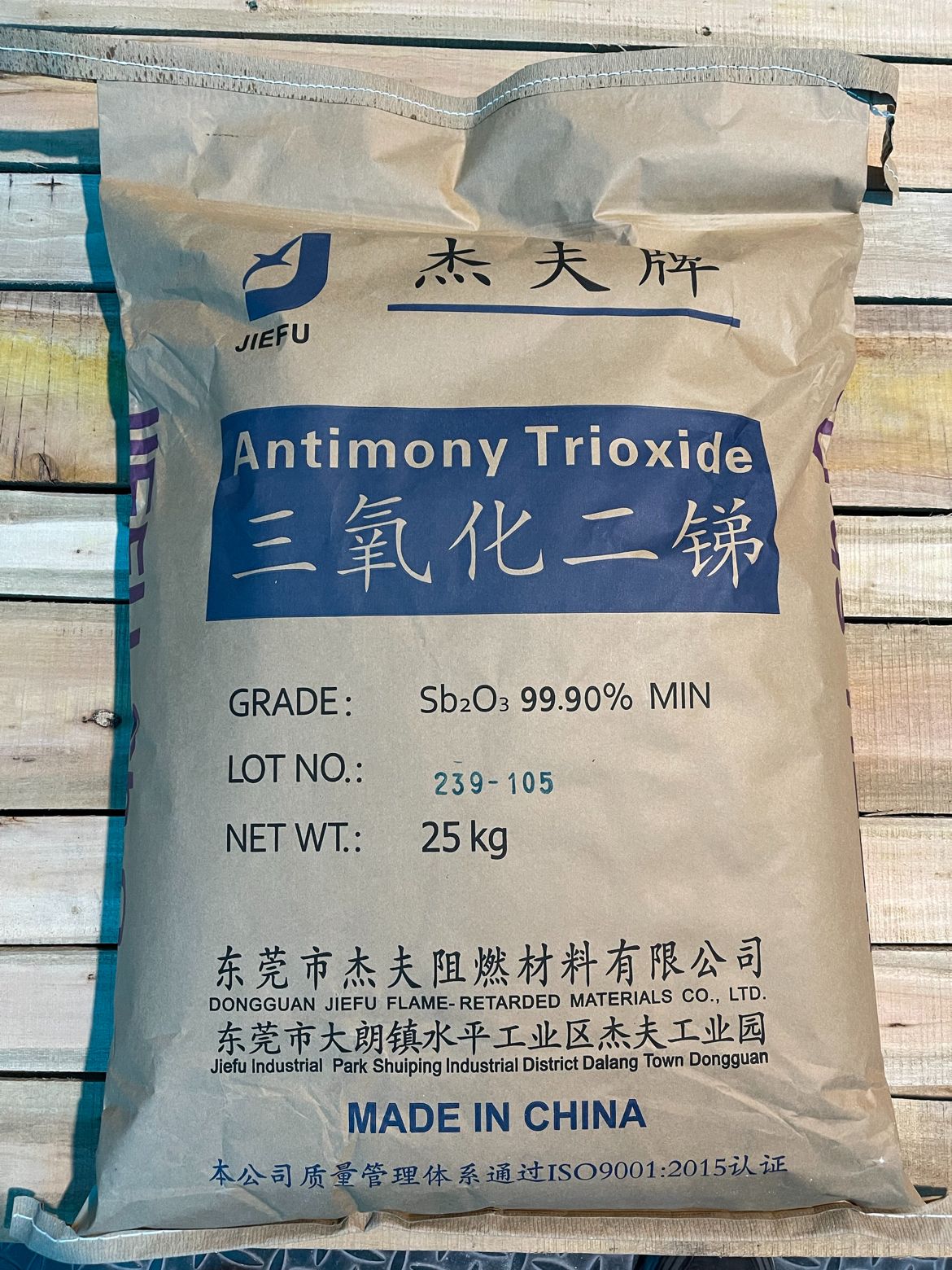

Antimony metal is known for being utilized in multiple military applications, semiconductors and alloys. Antimony trioxide is a white powder serving as a key ingredient in flame retardants, ceramics, glass manufacturing and other products.

“The sharp decline aligns with expectations from market participants following China’s intensified crackdown on unauthorized exports of strategic minerals,” said Du, “including antimony, gallium, germanium, tungsten and rare earths.”

He added that Chinese traders reported stalled trans-shipments and tightened customs inspections last month.

Only six countries received antimony trioxide shipments throughout May with the vast majority making its way to Southeast Asia, Du highlighted. About 60 tonnes went to Thai customers while 50 tonnes made its way to Indonesia. The rest was divided among Kazakhstan, Egypt, Uzbekistan and Vietnam.

The Fastmarkets reporter also pointed out that several Chinese smelters have been significantly reducing or suspending their antimony output due to the sharp drop in shipments making their way out of the country.

The United States, one of China’s top antimony customers, has been hit the worst by the recent national security-focused measures. The total export ban to the U.S. came as a result of the ongoing trade war between the two global superpowers — primarily linked to American restrictions imposed on China’s semiconductor industry. The Chinese formerly supplied 63 per cent of American antimony imports.

Global export controls implemented by China in September have also had an immense impact on the European supply chain in particular. No antimony shipments have been sent to EU nations since the end of October.

Read more: NevGold’s latest drill results extend priority target at Limo Butte by over 200 metres

Antimony’s price has skyrocketed, currently sitting at US$60K per ton

It has become a smoking hot commodity that has been pulling an unprecedented amount of interest. Demand for the metalloid hasn’t been this high since the Second World War.

The immense shortage in North America has become a major problem for U.S. military equipment contractors like Lockheed Martin Corp (NYSE: LMT) (ETR: LOM), battery makers, solar product manufacturers, and government agencies like the Department of Defense.

The DoD and U.S. Army have been investing millions into the Stibnite gold-antimony project under development by Perpetua Resources Corp (TSE: PPTA) (NASDAQ: PPTA) to secure a reliable domestic supply. It will be capable of meeting over one third of the nation’s demands, but production won’t be possible for another couple of years.

Early-stage American mining projects with proven antimony mineralization, like Nevada’s Limousine Butte project being advanced by NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50), are becoming increasingly attention-worthy too.

Fastmarkets is a renowned commodity pricing analytics firm based in the United Kingdom. The information services agency is highly knowledgable about the metals and mining sectors.

Read more: NevGold pulls up even more promising antimony grades from Nevada property

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com