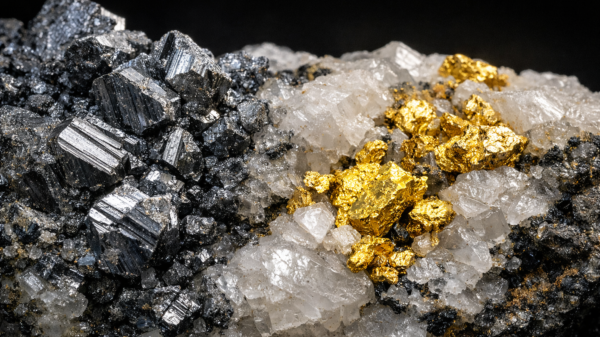

Gold just hit record high of US$3,057 per ounce, but what goes up must come down and “the cure for high prices is high prices,” according to a prediction from Morningstar.

In an interview with Bloomberg this week, the Chicago firm’s chief American market strategist, David Sekera, said the metal’s bull run is slowly coming to an end.

Within the next four or five years the popular commodity will only be worth about US$1,820 an ounce, he says, descending back to a level observed in 2023.

“This prediction from our equity research team is based on a combination of their supply and demand analysis over the longer term and their estimates for extraction costs,” Sekera explained in the interview. “Those factors that have historically resulted in higher gold prices are starting to wane.”

He added that lowering inflation, interest rates and energy costs in the near-term combined with spending cuts made by Elon Musk’s new Department of Government Efficiency would help make gold prices slide.

Currently, Morningstar says it still has a bullish outlook for stocks like Newmont Corporation (TSE: NGT) (NYSE: NEM) (FRA: NMM) and Barrick Gold (TSE: ABX) (NYSE: GOLD) (ETR: ABR).

Smaller international gold producers like Calibre Mining Corp (TSE: CXB) (OTCMKTS: CXBMF) (FRA: WCLA) may also be worthy of consideration.

Read more: Equinox Gold acquires Calibre Mining for $2.6B

Read more: Calibre Mining beats updated gold production guidance with 242,487 ounces

Sentiment is shared by British analyst

The UK-based commodity researcher Metals Focus says that gold has been an attractive safe haven asset for many investors recently. However, economic precariousness and geopolitical stresses will eventually stagnate, the consultant believes, thereby causing interest in assets like gold to dissipate.

“As we progress into the latter part of 2025, the investment case for gold will become less attractive,” the consultancy’s analysts said in a recent research note. “Once investment inflows into gold slow, this should start to create downward pressure for the gold price.”

Metals Focus has highlighted that this is largely attributable to “assumptions that the financial markets will get more clarity on tariffs” and that the American economy will manage to avoid falling into a recession for the remainder of 2025.

The firm sees gold prices hovering around US$2,600 per ounce for the rest of the year after an inevitable drop begins in the coming months.

For those holding onto significant quantities of the metal, now might be an optimal time to sell.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com