The Fall Mining Showcase hosted by Red Cloud Financial Services returned to Toronto earlier this month and featured presentations from renowned industry figures and several companies producing different commodities.

The conference was held on Nov. 7 and 8 at the Sheraton Centre Toronto Hotel.

The two-day event started with opening remarks from Red Cloud’s Managing Director and Head of Equity Research David A. Talbot, who has had an extensive career in the mining industry.

The first day’s keynote speakers included Rob McEwen, Chairman and Chief Owner of McEwen Mining Inc. (TSX: MUX) (NYSE: MUX). McEwen discussed economic difficulties in Canada, the questionable spending of the country’s Liberal government abroad and a lack of young people pursuing careers in the mining industry among other things.

“We need to change the perception so that kids going through school elect to go into mining engineering, geology or other fields of study related to mining. We just have to make it look more attractive, it’s a very high-paying industry and there are all sorts of skills that are required there,” said McEwen.

Other speakers that day included Frank Giustra, President and CEO of the investment firm Fiore Group; and Nicolas Carter, Executive Vice President, Uranium at the market research and analysis company UxC LLC.

The keynote speakers for day two were the Chief Operating Officer of Benchmark Mineral Intelligence, Andrew Miller and Michal Gentile, Co-Founder of the investment firm Bastion Asset Management.

Mining companies in attendance included the Canadian junior gold explorer Abcourt Mines (TSX-V: ABI), Blackrock Silver (TSX-V: BRC), the junior nickel and diamond miner Churchill Resources (TSX-V: CRI), Denarius Metals (TSX-V: DSLV), the Newfoundland gold mining company Exploits Discovery (CSE: NFLD), ATHA Energy Corp. (CSE: SASK) (OTCQB: SASKF) and several others.

Our CEO Troy Boisjoli highlights our strengths as a #uranium explorer in the Athabasca Basin:

✅ Unparalleled land position

✅ 125 Km of conductive strike length already identified

✅ Data from 13 of 17 projects to be announcedVideo: https://t.co/g09CXdhQCv$SASK $SASKF pic.twitter.com/eA9MsZGvap

— ATHA Energy Corp (@athaenergycorp) November 14, 2023

Read more: ATHA Energy aerial surveys over Athabasca Basin reveal strong potential for uranium

Read more: ATHA Energy well-positioned to capitalize on world’s best uranium jurisdiction: TF Metals interview

Several uranium mining companies attended

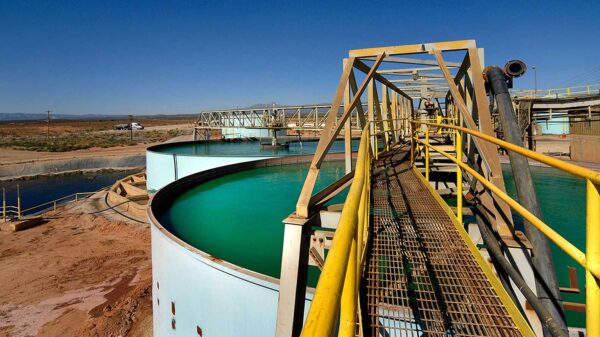

ATHA discussed its strategic position in the global uranium market and Canada’s Athabasca Basin in particular. ATHA became publicly traded in April this year and was established to take advantage of the rising demand for nuclear energy and rich uranium mining jurisdiction Canada holds.

The company has the largest land position in an area producing the highest-grade uranium in the world, spanning 3.4 million acres. ATHA recently completed the largest electromagnetic survey in the history of the Athabasca Basin, requiring seven helicopters to work simultaneously.

The company is currently processing the vast amount of geological data it obtained through the survey and aims to start breaking ground by the end of next year.

“We anticipate having a significant portfolio of high-probability exploration targets within the first half of 2024,” said ATHA’s CEO Troy Boisjoli at the event.

Other uranium mining companies in attendance included ALX Resources, Anfield Energy (TSX-V: AEC), Australia’s Aura Energy (ASX: AEE), Consolidated Uranium (TSX-V: CUR) and the American uranium producer Energy Fuels (TSX: EFR).

Consolidated Uranium discussed its merger with IsoEnergy Ltd. (TSX-V: ISO), a company active in the Athabasca Basin.

“The goal here is to build a globally significant uranium producer with multiple assets in multiple jurisdictions. If you look at the asset base between the two companies you’ll see that they are very complimentary,” said Philip Williams, Chairman and CEO of Consolidated Uranium.

Red Cloud Financial Services also operates Red Cloud Media, which is used to help mining companies attract investors through digital marketing campaigns. The company is headquartered in Toronto.

ATHA Energy is a sponsor of Mugglehead news coverage

rowan@mugglehead.com