Shares of Cresco Labs (CSE: CL) took a 11 per cent hit Tuesday after the multi-state cannabis operator posted a mixed bag of fourth-quarter results the night before.

On late Monday, the Chicago-based company released its financial results for the fourth quarter and full year ended Dec. 31, reporting total revenue of US$41.4 million and US$128.5 million, respectively.

Cresco said a 14 per cent quarter-over-quarter revenue increase in Q4 was mainly because of higher sales generated in Pennsylvania, Illinois and Arizona. The company also said it has been collecting additional revenue since October 2019 from the acquisition of two weed retailers — Valley Ag based in New York, and Hope Health Health in Massachusetts.

Despite the uptick in fourth-quarter revenue, Cresco’s bottom line weakened significantly.

The company reported a fourth-quarter net loss of US$45.2 million, which ballooned 81 per cent from a third-quarter loss of US$8.6 million.

Cresco said its bottom line was weighed down by US$7.2 million in acquisition and other non-core costs. The company also reported US$4.2 million in share-based compensation and US$3.4 million in expansion, relaunch, and rebranding costs.

The U.S. pot firm ended the fourth quarter with US$49.1 million left in cash reserves. But in the final weeks of 2019, the company said it closed a sale-leaseback agreement for its Illinois cultivation facility for US$50 million.

So far in 2020, Cresco said it closed two more sale-leaseback deals worth a combined US$28 million, while also securing a US$100-million loan.

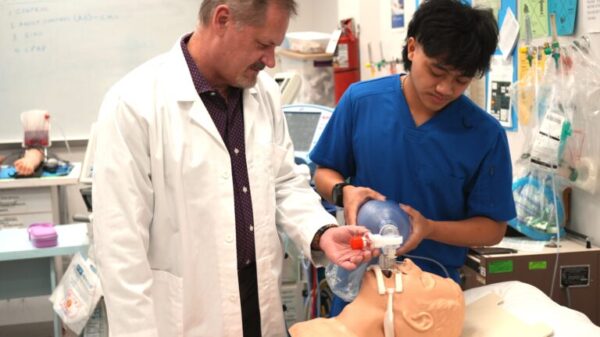

Cresco Labs unveiled its five Sunnyside branded dispensaries in Illinois on On Dec. 30, 2019, which are all still operating during the COVID-19 pandemic by offering curbside pickup. Press photo

Closing acquisitions paint Cresco’s future

The company’s 2019 acquisition flurry created a larger need for the increased capital. On Jan. 8, 2020, Cresco said it sold US$30 million worth of stock prior to closing its Origin House (CSE: OH) acquisition.

The cannabis operator said adding Origin gave it “substantial California wholesale distribution,” and that the company’s revenue in the fourth quarter would have reached US$56 million if it counted Origin’s total revenues.

Cresco expects to report US$66.5 million in revenue for the first quarter of 2020, with much of the 61 per cent growth from Q4 coming from the Origin House acquisition.

But “given several recent changing dynamics,” the company said it terminated its US$282.5 million deal to buy private weed firm Tryke, which operates in Arizona and Nevada. The break-up will save Cresco US$55 million in cash, according to a statement.

CEO Charlie Bachtell said Cresco is building the “most important company” in cannabis by getting its branded products onto third-party shelves in the 11 states it already operates in.

“Building on our success last year, in 2020 we are focused on: expanding our market-leading position in Illinois and Pennsylvania; integrating our newest assets and turning California into a center of profitable growth; and building a scalable foundation in other important states,” he said in a statement. “By achieving success in these focus areas, we expect to transition the company from adjusted EBITDA positive to cash-flow positive progressively through the year.”

Cresco reported a positive adjusted EBITDA of US$2.9 million in Q4, a slight drop from the US$3.3 million it reported in Q3.

Gross margins for the fourth quarter, accounting for all company costs, came in at 33 per cent.

In the last two months, Cresco said it worked side by side with state administrations to help cannabis achieve ‘essential’ status amid the COVID-19 pandemic.

Read more: Cresco Labs to hire 250 service industry workers

Top image via Cresco Labs

jared@mugglehead.com

@JaredGnam