Fire & Flower Holdings Corp.’s (TSX: FAF) (OTCQX: FFLWF) digital strategy is starting to blossom, according to its latest earnings report, bringing in significantly more revenue than the company’s other segments.

On Tuesday, the firm released its second-quarter financial results for the 13-week period ended July 31.

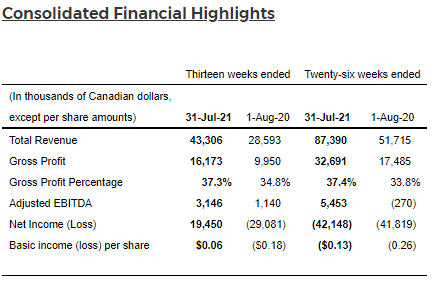

Revenue for the period totalled $43.3 million, a 1.8-per-cent decrease from $44.1 million in the previous quarter ended May 1.

From those sales, Fire and Flower reports gross profits of $16.2 million, down 1.2 per cent from $16.5 million in Q1, and a gross profit margin of 34.1 per cent.

Chart via Fire and Flower

Comprehensive and net loss came in at $42.1 million this quarter, 31.7 per cent less than Q1’s $61.6 million in losses.

This is the firm’s fifth consecutive quarter of positive adjusted earnings before interest, taxes, depreciation and amortization. Increasing 34.8 per cent to of $3.1 million over $2.3 million last quarter.

As of July 31, total debt sat at $3.8 million with cash and short-term investment balances of $29.3 million.

Seven stores have been added to the Canadian network over this period, bringing the total to 91.

Building Hifyre platform paying off

While retail revenues dipped 5.4 per cent to $31.8 million from $33.6 million in Q1, the company’s other segments are performing better.

Wholesale revenues, which cover the distribution of weed products and accessories, went up 2.6 per cent to $7.8 million, from Q1’s $7.6 million.

Meanwhile, Fire and Flower’s online sales have notably increased quarter over quarter.

Hifyre, the firm’s digital platform, saw revenues reach $3.7 million this quarter, rising 32.1 per cent from $2.8 million last quarter.

Read more: Fire & Flower buying PotGuide for US$8.5 million

Fire and Flower has been expanding its digital strategy with the purchase of Wikileaf Technologies Inc. (CSE: WIKI) assets and PotGuide.

“As you can see by our recent results, this strategy is really starting to blossom,” says CEO Trevor Fencott, adding early investments in the platform have allowed for new growth opportunities.

“With very little capital investment at this stage, we are rapidly building and monetizing the most valuable asset to the cannabis market: customer engagement.”

He explains the company will continue to monetize its digital platform and build it into the retail network “to operate a cannabis retail platform unlike any of our competitors.”

In regards to the firm’s Nasdaq application, it says it has targeted Q4 for its U.S. listing.

On Tuesday, company stock fell 2.17 per cent to $0.90 on the Toronto Stock Exchange.

Read more: Fire & Flower plants roots in US with Palm Springs store

Read more: Fire & Flower eyes Nasdaq listing, reports record earnings

Update (2021-9-15, 10:00 a.m.): This article has been updated to reflect the completition of Fire and Flower’s purchase of Wikileaf and Potguide.

Follow Kathryn Tindale on Twitter

kathryn@mugglehead.com